|

| On Politics in the United States Right now (in the aftermath of the #NunesMemo ) |

This was also a week that saw a number of members of Congress rebuke the President as noted below:

Today @realDonaldTrump said I'd love to see a shutdown. Is this the moment he became our President?— Ted Lieu (@tedlieu) February 6, 2018

Or was it yesterday when @POTUS accused people of treason for not clapping?

Or was it when he used the term shithouse countries?

So many moments to choose from this year. https://t.co/0pMSVFDXZd

Mr. President, treason is not a punchline. pic.twitter.com/iQXyzHfTKS— Jeff Flake (@JeffFlake) February 6, 2018

We have also been assessing the horrific scenes out of Syria--including hospitals hit throughout Idlib Province. This is as we also have been assessing the on-going power struggle in South Africa as the ANC continues its' struggle to force President Jacob Zuma to resign. We have also continued to assess the on-going situation in Iran especially on the anniversary of the 1979 Revolution--President Rouhani held a Press Conference noting that he heard the People's Pleas. This is as protests continue onward and as American Dual Nationals continue to be held as noted in this Tweet by the Wall Street Journal's Farnaz Fassihi earlier this week:

#Iran judiciary this week for #American hostages:— Farnaz Fassihi (@farnazfassihi) February 6, 2018

Bail set for Karen Vafadari & Afarin Nayassari refused.

Medical Examiner's advice for temp release of Baquer #Namazi refused.

Our team was also assessing the on-going developments in the Maldives. Maldives is especially poignant as its' former President, Mohammad Nasheed (currently in exile in Sri Lanka), was one of the leading advocates for Climate Change as his own country is at the forefront of Climate Change--he even went as far as holding a Cabinet meeting under water. As there has been less and less focus on it in the United States, what we found so poignant was what the ever eloquent @KalToons noted about the state of Mother Earth right now:

|

| Earth Under Siege (Courtesy @KalToons) |

We could not help but be amused by this on the State of the Media in the United States as Fox News continued its' jealous advocacy of President Trump's agenda and as Sinclair builds out its' Media Empire:

|

| How Broadcasting is Under Siege (Beyond @FoxNews Courtesy @KalToons) |

As Syria Burns, Iran continues to deal with the aftermath of the protests, Turkey continues to attack Syria's Kurdish Region, Yemen continues to burn--there is Palestine. The Israeli Defense Minister came out to say there is no crisis in Gaza as Israel continues its' blockade of it--and as Gaza Hospitals have shut down based on the latest out of intifada. In the aftermath of the President's Decision regarding Jerusalem, this was published by Ahmed Tibi as Vice President Pence was in the region and the Arab members of the Knesset were manhandled and taken out:

What will Trump ask next from the Palestinians? Their consent to living under apartheid - and to say thank you? Opinion @Ahmad_tibihttps://t.co/tlqgq6aQy3

— Haaretz.com (@haaretzcom) January 21, 2018

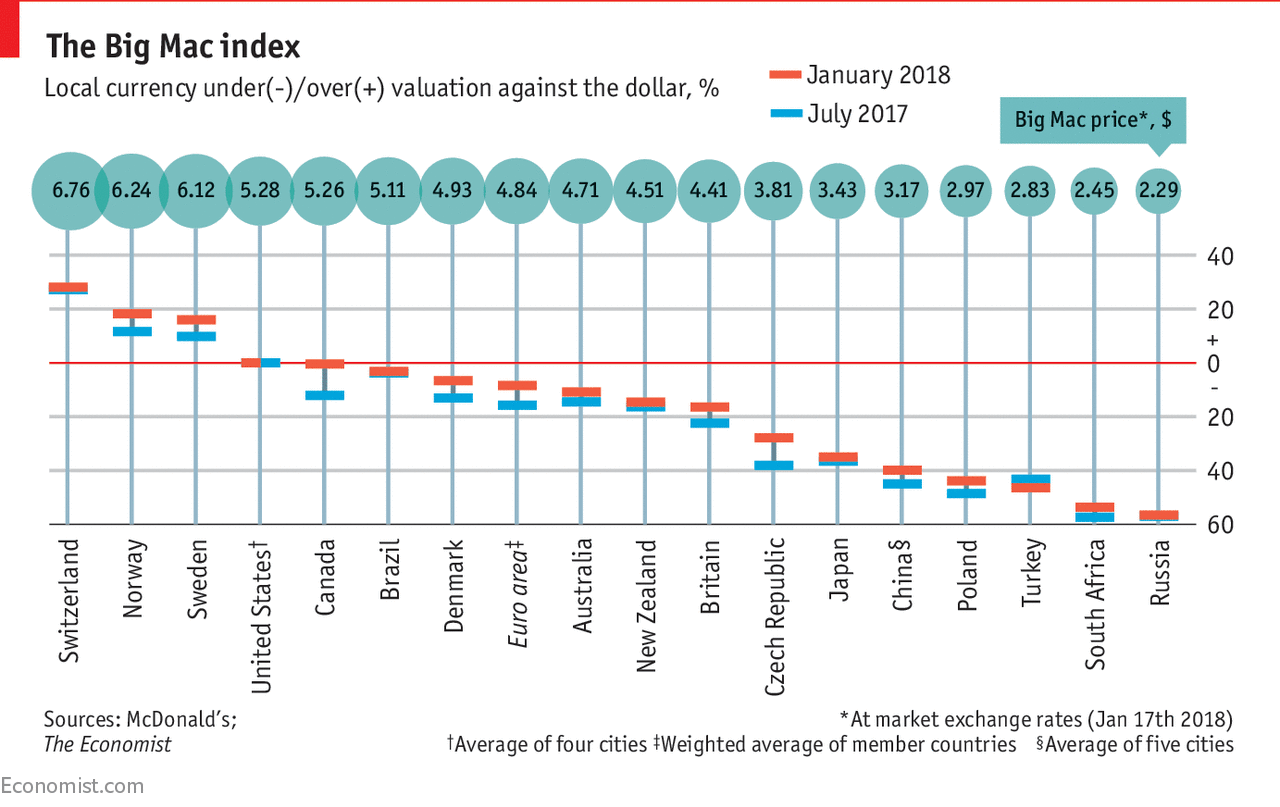

This was also an interesting snapshot of the State of our World especially as threats loom large in the World Economy:

Please enjoy this very upbeat view of our World and enjoy the write-up from Gates Notes here--for a free chapter, we urge all to consider signing up for Gates Notes:

We also hope all take heart with these thoughts complied by @Jonathan Lockwood Huie that we find inspiring and have featured throughout our properties:

If you cry because the sun has gone out of your life, your tears will prevent you from seeing the stars. - Rabindranath Tagore

Your success and happiness lies in you.

Resolve to keep happy, and your joy and you shall form an invincible host against difficulties. - Helen Keller

Only when life is difficult, are we challenged to become our greatest selves.

- Jonathan Lockwood Huie

Remaining ever so hopeful....